#19 - Trust Compresses Sales Cycles

Money is a representation of trust and transactions are an exchange of value.

When you buy something, anything, you trust that the product or service will live up to the assigned value you expected.

When you buy cybersecurity software you trust that your organization will be protected from hackers.

When you buy a sandwich you trust that it will taste good, satiate you and/or provide (some) nutritional value.

Yes, cold outreach’s effectiveness is eroding because of the sheer number of calls/emails executives receive - especially compared to 10 years ago.

However, it’s also because prospects don’t believe the widget you are slinging will be impactful. There are lots of widgets to choose from. You are a sales rep. And sales reps are incentivized on transactions - not customer value.

As a result, buyers are averse to evaluating a product’s potential fit if the sales rep is the one building awareness. It’s hard to trust them.

This is not to say that you won’t be able to sell if cold is your primary strategy, but if it’s your only strategy, then expect long-cycles and low conversion rates. There are just too many market forces working against you in this current selling environment.

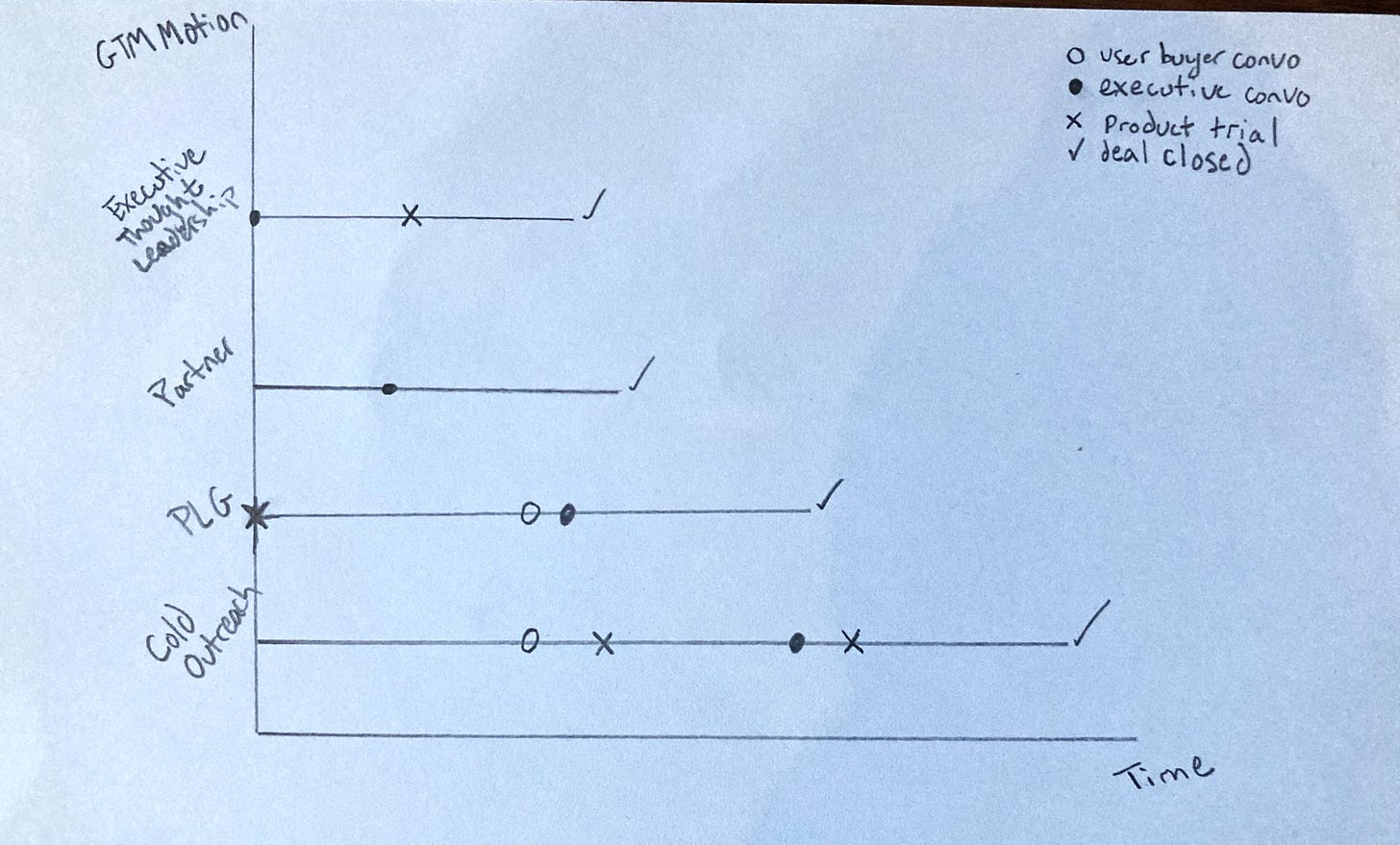

What can you do to increase trust, and thus, increase conversion rates + compress cycles? Three things:

Develop a Partnership Motion

PLG

Executive Thought Leadership

Partners - This is extremely important, especially in the enterprise. Enterprises have the most money with the most potential buyers, and as a result, receive the lion’s share of sales calls.

Cold should be a tertiary priority in these accounts. If you can develop relationships with partners who already do great work in the account, executives will take meetings with whoever they bring to the table when there is a need, and quickly decide if you can add incremental value to their business.

PLG - If you can architect a limited version your product, give it away for free through self-service and prove value to the end-user, you will gain significant credibility AND reduce CAC significantly.

What’s more likely to close (and close faster) - a meeting set by a persistent SDR who piqued the interest of an executive? Or, an executive meeting set by an end-user who has already implemented a limited version of your solution into their workflow…and wants to pay for more value?

Executive Thought Leadership - Best practices for developing brand awareness is changing rapidly. Hosting webinars, sending case-studies and promoting your products’ bells and whistles used to work. But, now that everyone is doing it, cutting through the noise is extremely difficult.

At the end of the day, people want to buy from people. Decision-makers are more likely to buy into your mission and the personal stories around why founders dedicate so much of their life to solving this problem.

Especially if the founder came from a role where they experienced the problem first-hand, they’ll gain an audience of target buyers saying, “Wow, I run into this challenge all the time, glad someone is tackling this. I hope they win.”

By building an audience of target buyers, and feeding them free value in the form of insights and analysis, they’ll be begging to talk to you.

This is an extremely scalable motion that will generate significantly more opportunities, shorten-cycles and increase your chances of winning.

What’s next for outbound? Leverage it strategically as a complement to these core pillars:

Build a roster of great partners, and have sales reps maintain a regular communication cadence in the form of pipeline reviews where they can pick apart which deals will receive the most value from a joint solution.

When an end-user begins using your product through PLG, have a sales rep call them up to see if they need help and guidance to ensure business outcomes are met.

When you post on LinkedIn (needs to be frequent), have a rep follow up with the executives that engage. A/B test whether rep or executive follow up generates more meetings and build a process based on those results.

As GTM organizations transition from growth-at-all-costs to managing a P&L, this will accelerate growth AND produce more profitable outcomes.