#20 - The Evolution of Tech Sales

How companies get their products into the hands of end-users constantly evolves. And there are hype cycles.

If you go to market in a novel way you have a first mover advantage and will get product to users before your competition.

If you invest in tired sales/marketing practices, and are merely following the herd (or worse, your competition), you are less effective in distributing technology. Your LTV:CAC metrics will suffer and you won’t hit growth targets required for scale.

In this industry CROs DO get fired for going with IBM - in this case a GTM playbook crystallized by VC firms. Ironically, it is the usually the VCs that force CROs to implement their playbooks that lead to their demise.

Talk about a Catch-22.

To compound this, innovative GTM playbooks are short-lived and hype-cycles are now compressed. When volume cold outreach exploded that hype cycle lasted for ~6 years and then PLG lasted for ~3 years.

These are still important GTM motions, it’s just that they aren’t innovative and their effectiveness in driving significant top-of-funnel activity diminished faster than its predecessor.

If you invest in them as if you are early to the hype-cycle, you’ll lose.

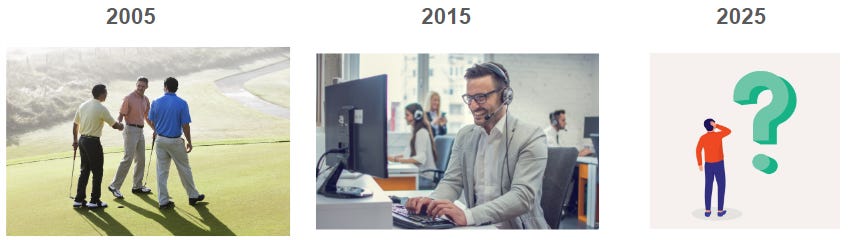

Here is a rough timeline of how this landscape evolved since 2000, and where it’s going next.

2005 - Golf and Steak Dinners

In 2005, CIOs were identified as the primary software buyers. Representatives from companies like Oracle and EMC capitalized on their extensive networks, successfully selling new products to these decision-makers even when they transition to different organizations.

2015 - Volume Cold Outreach

Fast forward to 2015, the tech industry witnessed an unprecedented growth that impacted every facet of businesses, regardless of their size. CIOs could no longer get all of their needs from big technology providers like Oracle and Microsoft. Smaller companies could innovate faster, and build better technology that more effectively advanced enterprise business objectives.

During this time, these new technology market entrants, buoyed by incredible sums of VC, hired cheap, inexperienced reps straight out of college. These reps cold called and cold emailed at a high-volume to their company’s target users to drive top-of-funnel.

This proved to be the fastest and cheapest way to get their product’s message to market and top-of-funnel ROI was significant.

2022 - PLG and Partner-first

The VC and early-stage tech industry became extremely bloated. To put simply, there are too many technology companies in the market with many of them solving challenges that don’t really move the needle on a company’s business.

Couple that with the saturation of volume cold outreach, and decision-makers are no longer willing to take any meetings without companies proving value first.

For PLG, tech users could play with tools in a limited capacity to see how it would work in their environment. If there is value and they wanted premium features, a credit-card needed to be swiped or a discussion with a sales rep to right-size scope was required.

Partnerships are not a novel GTM motion, but their importance was more readily needed. If a partner historically brought in a bunch of tools that helped decision-makers hit their business objectives, they have a lot of credibility. Thus any new solution they tell these decision-makers to evaluate will be well-received and more often than not, those sales cycles are very compressed.

If those “new” solution providers reach out to those decision-makers directly, the chances of getting a meeting (no matter how good the cold outreach) would likely be zero.

2025 - Building the Founder Brand

While Product-Led Growth (PLG) and partner strategies are valuable, they are not substantial game-changers. They are an important piece of the puzzle, but they are indirect sales motions, offer very little control/predictability over revenue goals and thus cannot be the primary growth engine.

How do company’s gain more control of top-of-funnel? Building the founder brand where one or more company executives are providing insightful thought-leadership on social media platforms (decidedly NOT product marketing).

These execs can build a loyal audience of target buyers that “buy-in” to their company’s mission and the market challenges their solution is solving.

People buy from people, and if executives can build an authentic, para-social relationship with their ICP, it’s a powerful inbound flywheel that represents an incredible top-of-funnel engine.

Sales reps shouldn’t create demand, the primary company evangelists should. If top-of-funnel is solved, they can focus their time on solutioning with customers and compressing sales cycles.