#22 - RIP VC-Backed GTM Playbooks

The 2010’s were an incredible time for B2B SaaS.

With the explosion of demand for “all SaaS everything” VCs were eager to invest in these incredibly high margin start-ups that more consistently returned capital at solid multiples.

Still, they were winner-take-most markets. So when one company gets funded, competitors were fast followers, and whoever grew the fastest won.

VCs piled billions of dollars into these SaaS companies to invest in growth. Cost didn’t matter as most winners exited without being profitable.

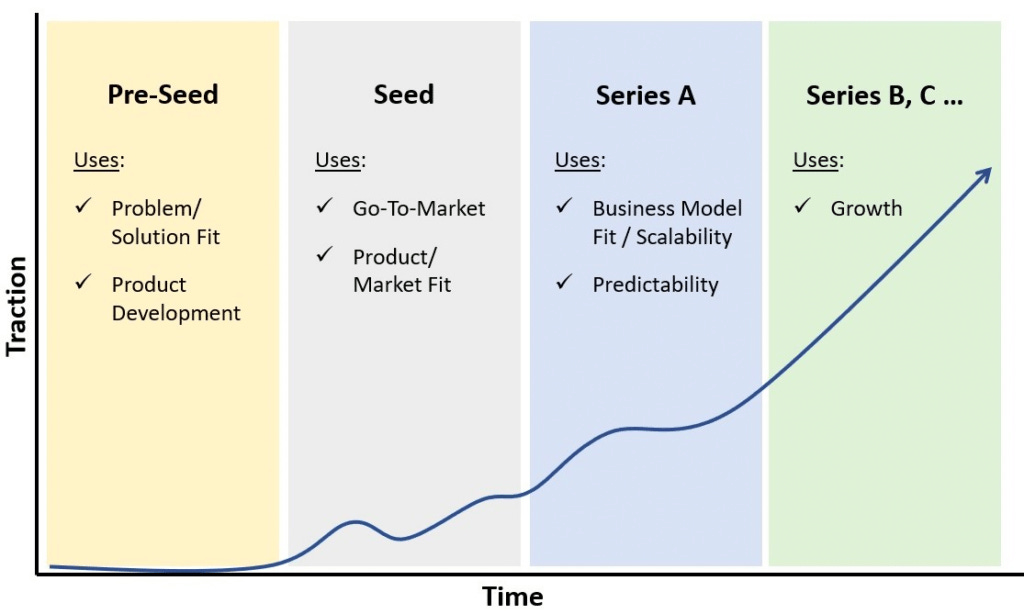

This is the typical life-cycle of a SaaS company during the 2010s:

Investors make an early-stage investment in a moonshot based on the charisma of the entrepreneur/CEO and not the business fundamentals. Nothing is inherently wrong with this, as they have their risk spread across several moonshots and will continue to invest in the 1 or 2 that work and let the ones that don’t burn.

Remember, they only need 1 out of 10 to hit to make a shit ton of money for themselves and their LPs.

Typically, the founder of the moonshot is young and product/tech focused. They’ve built an extraordinary technology that has the potential for major disruption – they just need to figure out market applications.

Once product-market fit is found, VCs pour more money in with the expressed purpose of boosting the sales/marketing function to grow faster.

Growth at all costs was the predominant mantra.

The VCs push for a VP of Sales that excelled at their last moonshot. They executed extremely well against the playbook that worked 5 years ago and are mandated to roll out that same playbook at this new company.

With clear instructions on what they need to do (i.e. roll out that playbook), the new sales chief spends the first quarter hiring 20+ people, a sales ops team to implement Salesforce and a Sales Enablement leader to master the playbook and get all new hires indoctrinated in the “culture of the playbook.” Before the first quarter ends the VP of Sales spent millions and no one has made a phone call.

At the end of the second quarter there is not a qualified opportunity in the pipeline despite 90-days of everyone executing flawless against the activity metrics the playbook dictates. Given that the board’s mandate to the sales VP is “roll out the playbook that worked at our last money maker” the VP doubles down on it, telling the sales force to just increase activity because the playbook is infallible.

When it continues not to work, many of the experienced reps leave on their own because the pipeline is bare and there’s no revenue to be found. They’ve seen this circus before and chalk it up to “it just didn’t work out.”

At the end of the third quarter the VP of Sales is let go along with most of the SDRs - the majority of whom came in every day and worked their assess off dutifully executing against the playbook.

This cycle repeats with 2 or 3 more VP’s of Sales, who essentially do the same thing i.e. implement the VC’s GTM Playbook.

The GTM Exec who is finally able to accelerate company growth and hit targets is simply the beneficiary of the market just finally coming around.

The story that both the investors and operators tell, however, is about the genius of the playbook and the executive team’s ability to execute. Not about market timing.

The good news is that we are fast approaching the extinction of this cycle.

As interest rates stay persistently high and the buying market remains in perpetual purgatory, investors, operators and everyone involved in the SaaS landscape is forced to reckon with new market realities.

At the peak of the post-COVID bubble, there were just too many SaaS companies with too many sales reps calling the same executives at the same enterprises. The “great leaning out” has forced many companies to figure out how to grow more cost-effectively.

Offshoring all but the most strategic sales efforts and building the founder brand have yielded better results at a much lower price point.

More pipeline opportunities with greater GTM efficiency will be the operating philosophy of the future even when buying cycles return to normal and new bubbles are formed.