#25 - Goodbye J-Curve

What is a J-Curve?

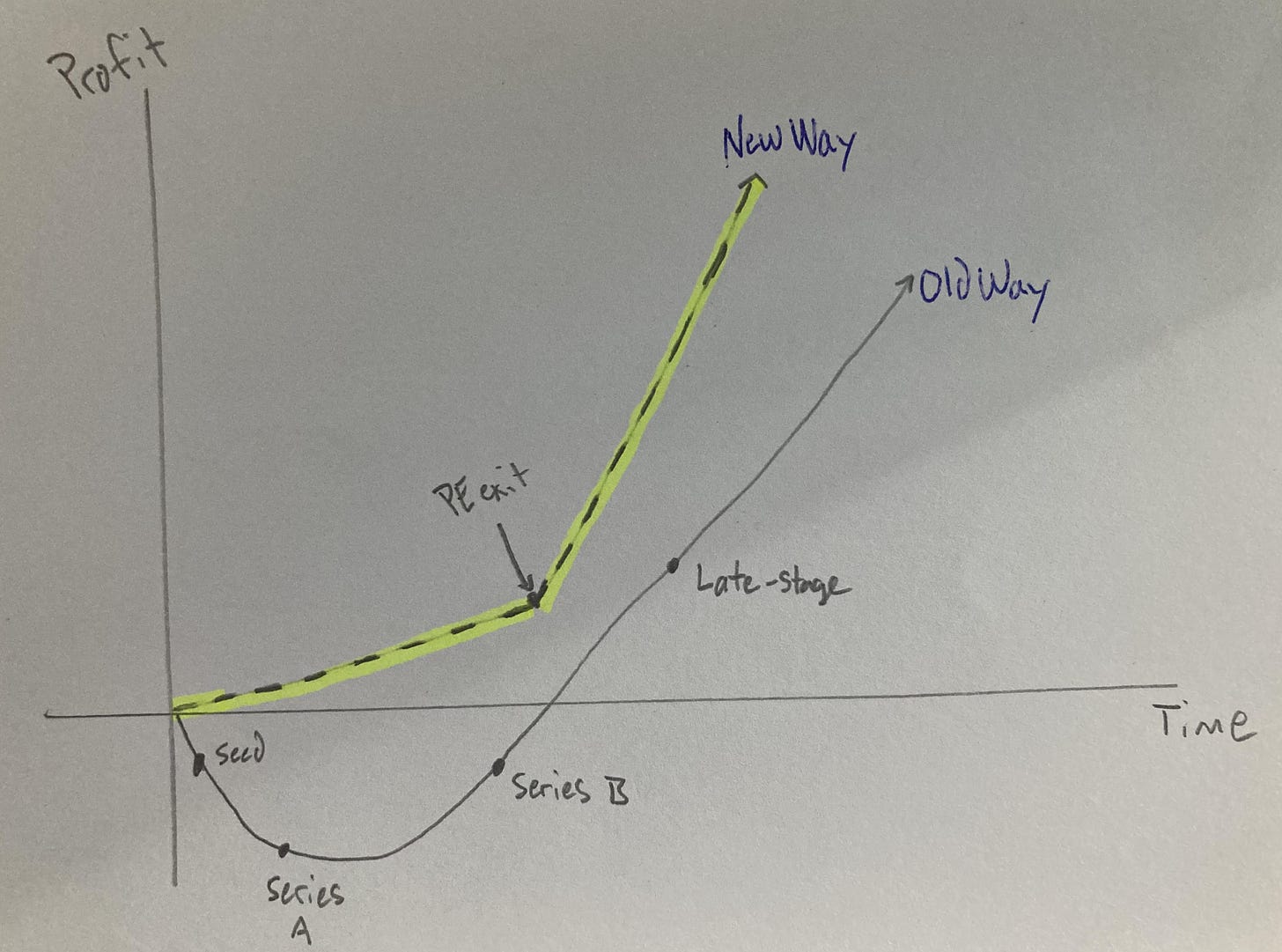

In economics, J-Curves are a trendline that show an initial loss followed by a dramatic gain.

For a VC-backed company the initial downward slope of the “J” outlines the first few years of experimentation.

They’ve raised a seed round to build a team and product to prove out a hypothesis around a market gap. Costs far exceed revenue during this phase.

Once they figure things out and begin to scale the gap between revenue and cost shrinks. Once revenue=costs the “J” bottoms-out and the slope trends upward as the company marches towards profitability.

The same principles can be applied to VC/PE funds.

VC/PE firms raise funds from LPs. Once they hit their fundraising target, the fund lifecycle begins.

The “J’s” downward slope marks the first few years of deploying capital.

As their investments appreciate in value and they begin realizing distributions, the fund’s J-curve bottoms out and the curve ascends once distributions > deployments.

2024 and beyond…

During the “golden age of SaaS” (2010-2022) the J-Curve was a widely-accepted principle that governed the entire VC ecosystem. It was taught in business school classes as a standard; a best-practice that you needed to understand in excruciating detail if you wanted to work in tech as an operator, founder or investor.

Moving forward the J-Curve will become extinct.

Why?

With tools like Stripe, Wix, no-code/low-code tools, et al. solo founders can start companies, sell products and generate profit with minimal overhead.

If they hit on something big, they can reinvest profits to implement, configure and operationalize the right suite of low-cost AI tools to achieve economies-of-scale.

Thus, companies can generate significant profits (quickly) without ever needing to take on outside investors.

And for the investors? Well, simply put, once founders realize they can generate profits without outside influence the VC-industry will experience a massive right-sizing.

Later stage PE will still act as an exit vehicle for founders who build great bootstrapped businesses. Their “J-Curve” will exist in building the equity value in the companies they acquire above and beyond the cost they paid for them.

The point?

5-10 years ago, you needed to raise significant capital to build a team, then build a product, then find a massive market, then beat competition, and then (if you’re lucky) generate profits. A long slog.

Today you can build a great and profitable company without any outside capital/influence.

How do you embrace this paradigm shift?

Find a niche market you are uniquely able to serve.

Build something quick to serve them and generate profits quickly.

Reinvest the profits to scale, and fully exploit that niche market.

Only raise capital if there is a significant opportunity to scale beyond this niche and build towards $100m in revenue at extremely high margins.

A company’s ultimate goal is not to raise capital. It is to offer a solution to a problem. The cost of building a solution is exponentially lower than it was even five years ago. Founders should take advantage.