#27 - the one about Clay...

Clay raised $62M at a $500M valuation. The second shoe to drop following Apollo crossing unicorn status in August.

The sales platforms powering the “Golden Age of SaaS” are now under even more pressure to change their business models to align with macro shifts.

Gong, Outreach, Clari, etc. all sit above $1B valuations in the private markets. Their value is tied to improving sales productivity for large and expensive sales teams through mechanisms that no longer accelerate pipeline/revenue growth.

Currently they rely on locking customers into massively expensive annual contracts, based on a per-seat licensing model.

Growth has surely slowed to a crawl, and churn has skyrocketed as GTM organizations operate with significantly greater efficiency.

Emerging platforms like Clay are more flexible and designed to drive value based on usage, not seat count.

As the new generation of platforms gain greater adoption, improve their capabilities and become the new standard, the “old guard” will be lucky to sell to PE at their current valuations.

Clay is great. I’ve implemented into my workflow and it’s saved me upwards of 6 hours/week and is more effective in driving meeting conversion. However, they still need to build out more functionality for me to feel comfortable fully replacing my tech stack that includes Outreach.

With this new round, here are some thoughts on where they should and shouldn’t invest (this is just me spitballing so take it for what it’s worth):

Sales Execution

Clay can do everything up to the point of outreach, which makes a sales execution platform like Salesloft, Outreach or Apollo.io still necessary to actually reach out to the folks you’ve prospected.

Given how mature the space is, it could be in their interest to build this feature set into the existing platform and compete directly with the incumbents.

However, the cost/benefit analysis may not make sense if it pulls them too far away from their core.

A better bet may be forming a very, very tight integration with Apollo in an effort to stamp out Salesloft and Outreach.

If they can accomplish this with an economic relationship (a back-and-forth pay for premium) and a UX that allows customers to leverage each solution’s capabilities from one platform, that combination will be the standard GTM tech stack for sales teams moving forward.

A monster merger in the next few years is fun to think about too.

Integrations/Workflows/Partnerships

See Apollo.io suggestion above.

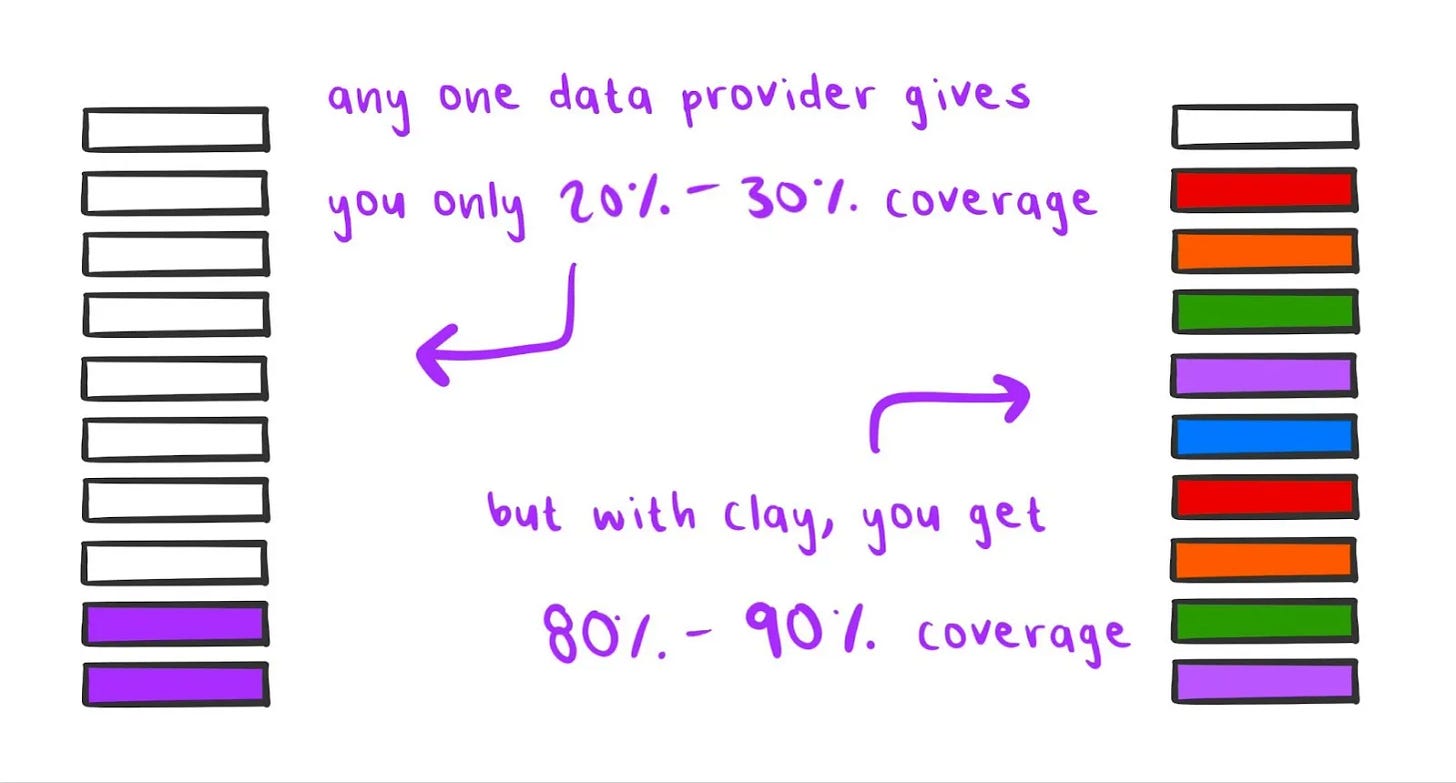

They have already done a phenomenal job of integrating with dozens of sales data and sales execution tool in the sales tech ecosystem. This gives them a unique competitive advantage in data accuracy AND introduces insane customization into their offering. Double down here.

Maybe create a marketplace where buyers can buy the rest of their tool set through the Clay platform and take a fee from the platform providers? Even better, offer more robust features from their partners, inside the Clay platform so that reps don’t have to operate anywhere else.

As it stands today, the per user pricing model is pretty cheap. Which is great as they enter hypergrowth mode at incredibly low CAC (they don’t have a sales team). However, I can’t imagine their top-line is overly impressive.

If they can become the one platform every sales rep uses, addressing all of their needs, and can monetize it effectively, they will easily become the winner in the space.

AI Email Copywriting

No one has put out a good product in this category. Clay has a distinct advantage because of all the datasets they are leveraging to power the rest of their functionality.

If they can develop great copy, that looks and sounds authentic, and scrapes information from far more than just a prospect’s LinkedIn profile (e.g. incorporate highlights from a 10-K) there is opportunity to win here as well.

Performance-Based Pricing

They do not lock you into annual contracts. You pay a low-price entry fee, month-to-month which provides users a certain amount of credits. You can pay for more credits if you are realizing value, but if not, you can cancel anytime.

Ensuring that revenue is tied to value, and building their operational infrastructure around this, is a win-win for customers and the business. If they can add additional revenue streams at extremely high-margins through their existing technology partnerships, this can be a major driver for long-term growth.

No Sales People

They have a great PLG and word-of-mouth machine that has led to explosive growth. Maintain this until you really need high-end sales people to drive massive enterprise deals with a lot of complexity.

Customer Success

One knock against them is that it is really hard to get up and running.

Their value proposition lies in their ability to build very customized, and accurate target company and prospect lists based on your unique business objectives. This significantly increases your ability to reach the right people with the right message, quickly.

The downside is that it is still really difficult to customize to your specs when you’re first starting out and there is very little in the general FAQs to help.

Additionally, it’s hard to get a CSM if you are only paying ~$80/month - nor is it worth it for them to build out a super large team, as most of the adoption issues are pretty easy hurdles for users to overcome.

Building a robust library where you can easily query and access very customized solutions would go a long way in initial customer adoption, ensuring users realize value quickly and then incentivizing them to do more. It is also infinitely scalable and requires minimal overhead.

This will ultimately maximize LTV.

Conclusion

When companies were incentivized to “grow at all costs,” LTV:CAC was an elusive metric.

If Clay can remain lean, invest heavily in product, partnerships and high-quality implementation/CS (without having to spend significant $$ on sales/marketing) they have a unique opportunity to achieve significant profitability and be the single platform to rule them all in the age of profitable, efficient growth.