#29 - Per Seat vs. Consumption

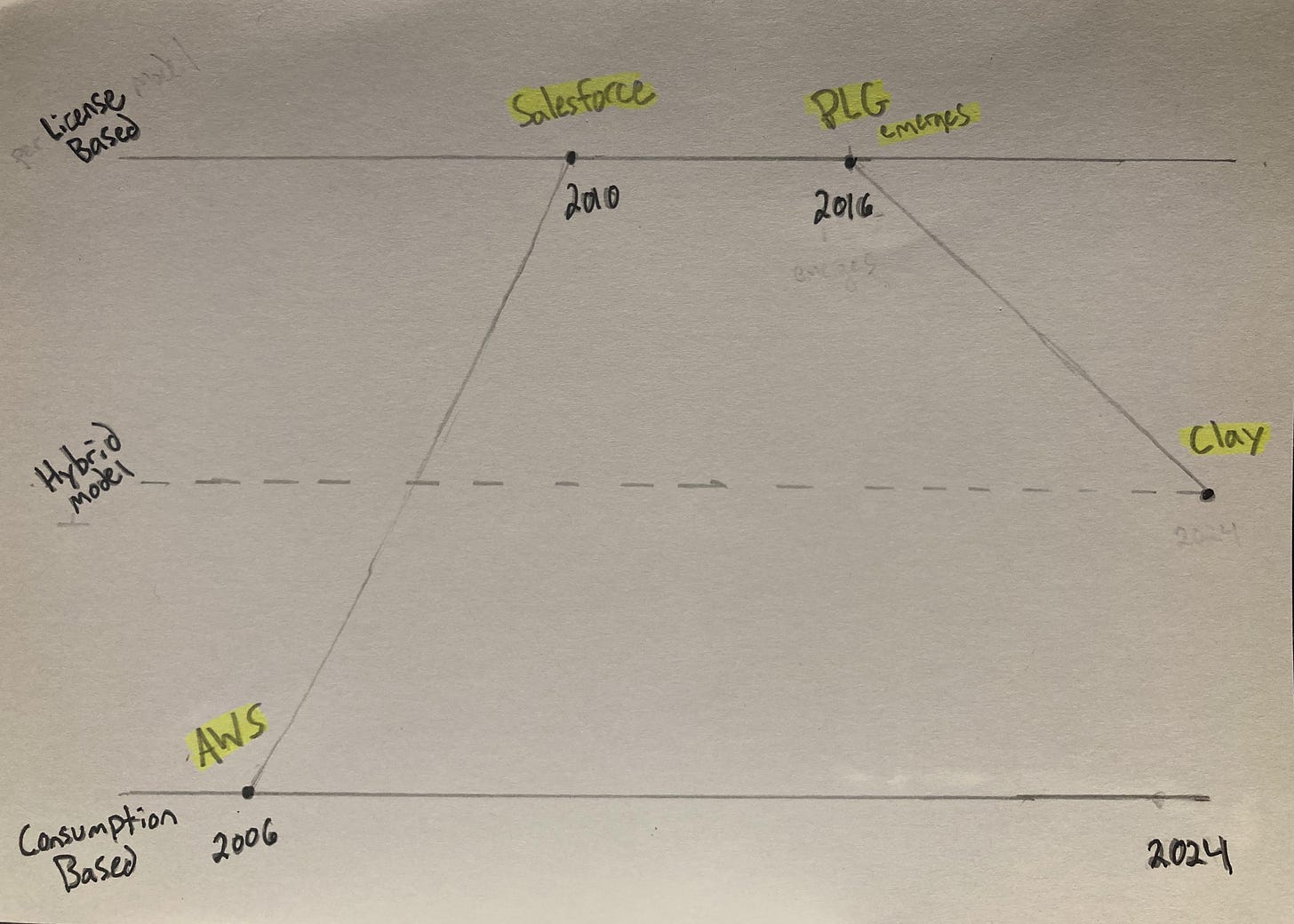

When AWS launched in 2006 they came to market with a consumption based licensing model.

They ushered in the cloud era and had a first mover advantage with the pay-for-use model. It proved extremely lucrative.

In the early days of evaluating AWS technical teams did not have a full understanding of the amount of data they would need to store in the cloud. Only paying for what they used was a revenue model they could get on board with.

However, as companies produced exponentially more data runaway costs became significant.

AWS enjoyed explosive growth as a result - it’s market cap would likely be over $1T if it were a standalone company. And while customers see immense value in AWS, a whole market of solutions have exploded to help AWS users better manage their monthly compute bills.

In the immediate years that followed software vendors working with tech teams had a tough time selling consumption-based solutions.

Contracts based on headcount (i.e. per seat revenue models) became the de facto revenue model of the SaaS era. Companies could easily forecast headcount, and thus, forecast yearly spend with any given solution.

Industry Standard (2010-2022)

The trade-off for customers opting for per seat licensing models was a commitment to long-term (typically annual) contracts based on current user headcount. If that headcount grew, so did incremental revenue.

Both sides were fine with this.

Customer’s expected usage based on headcount growth was easy to forecast, calculate and budget.

Vendors were happy because the long-term contracts helped ensure they could accurately forecast revenue growth for quarterly board meetings.

And when the flood of money came roaring in during COVID, both sides were elated. More money meant more growth. And more growth meant more headcount. And more headcount meant more licenses.

A virtuous circle of sorts.

However, when interest rates rose and growth came to a halt, the proverbial music stopped.

The Great Leaning Out (2022 - Now)

While we’ve not seen a recession (yet), this slowdown hit tech hard.

A disproportionate amount of COVID money found its way to the tech sector leading to massive bets in highly speculative industries without regard for business fundamentals.

Once the tide went out markets began caring a lot more about profits, cashflow and three-letter acronyms like LTV, CAC, and NRR. Big visions and cool ideas in slide decks were worthless.

Headcount is always the first thing to address during these busts.

Companies implemented mass layoffs to reduces burn rates, increases cash and extend runway. The headcount reduction across the industry had a long-tail affect on the per license business model.

Reduced headcount reduced need for licenses. Once annual contracts expired customers needed to renegotiate terms, or in many cases, churn those products out of their operations completely.

This set in motion a vicious cycle of more layoffs as revenues dried up.

As a result, the next wave of emerging tools are moving away from the per license revenue model and moving towards a more manageable consumption based revenue model.

What’s changed since AWS?

First, in this current macro, cost-conscious companies are unwilling to commit to long-term annual contracts unless they’ve already realized significant value.

Second, PLG is now industry standard. If there is no try before you buy (or try cheap before you buy big) option there is no transaction, period.

End-users expect they can use the tool, easily implement it into their workflow and quickly determine if the productivity gains justify a buy decision. That trial better give them a really good understanding of their consumption needs.

These forces require solution providers to significantly reduce Sales & Marketing investment to gain market share. That capital is now allocated to building an extremely valuable product with gated functionality optimized for pricing.

While the revenue is less predictable, designing an operating model based on user-feedback loops increase product stickiness which unlocks incremental value, leading to organic and sustainable revenue expansion over the long-term.

Once this feedback loop is stabilized sales reps will be required to manage complex enterprise deals, but they will join much later in the company maturity life cycle.

In short, usage-based pricing is back with little-to-no trade-off from the customer. Vendors must counter this by minimizing S&M costs and overinvesting in building an extremely valuable product for the end-user.