#30 - IP Value in B2B

SaaS businesses, profitable or not, are acquired based on a multiple of Revenue.

Profitable service businesses are acquired based on a multiple of EBITDA.

Over the past decade or so, raw dollar amounts for SaaS acquisitions significantly outpaced their often much more profitable service counterparts.

Software companies grow faster with significantly greater operational efficiency - thus, their projected future cashflows will be exponentially higher.

Until 2023, the moat for SaaS companies was their ability to raise capital to hire an engineering team, build a product and test the market. If the company finds something that works they raise more and build a GTM organization to scale.

In essence, even if a bootstrapped services business solved the exact same problem as a SaaS product (perfect substitutes), the software is infinitely scalable once the product development infrastructure is built.

The Rise of AI

Over the next few years, however, the ability to build software will commoditize and the “VC moat” SaaS companies enjoyed will evaporate.

With an ability to prompt engineer code using sophisticated LLM models services companies can build software solutions without engineers or upfront capital.

For buyers this will be great - more competition will lead to more optionality at more favorable price points.

For suppliers this decreased barrier to entry means more competition and less opportunity for market capture. Greater operational discipline will be required to generate profits with an expected lower growth ceiling.

This will result in a really robust ecosystem of digitally-enabled small businesses, which will be awesome for the economy in general.

Acquisition multiples will compress.

The Value of IP

Seinfeld is one of the most popular TV shows of all time.

While Larry David and Jerry Seinfeld were both paid handsomely when the show was running in the 90s, they are billionaires because they own the IP.

The majority of that wealth was created after the season finale as networks (e.g. TBS) and streaming platforms (e.g. Netflix) paid - and continue to pay - top dollar for syndication rights. The best part? No additional operational cost/resources were required from Jerry and Larry to realize that exponential growth in value.

IP, like SaaS, is an infinitely scalable business with an incredible and defensible moat rooted in brand value.

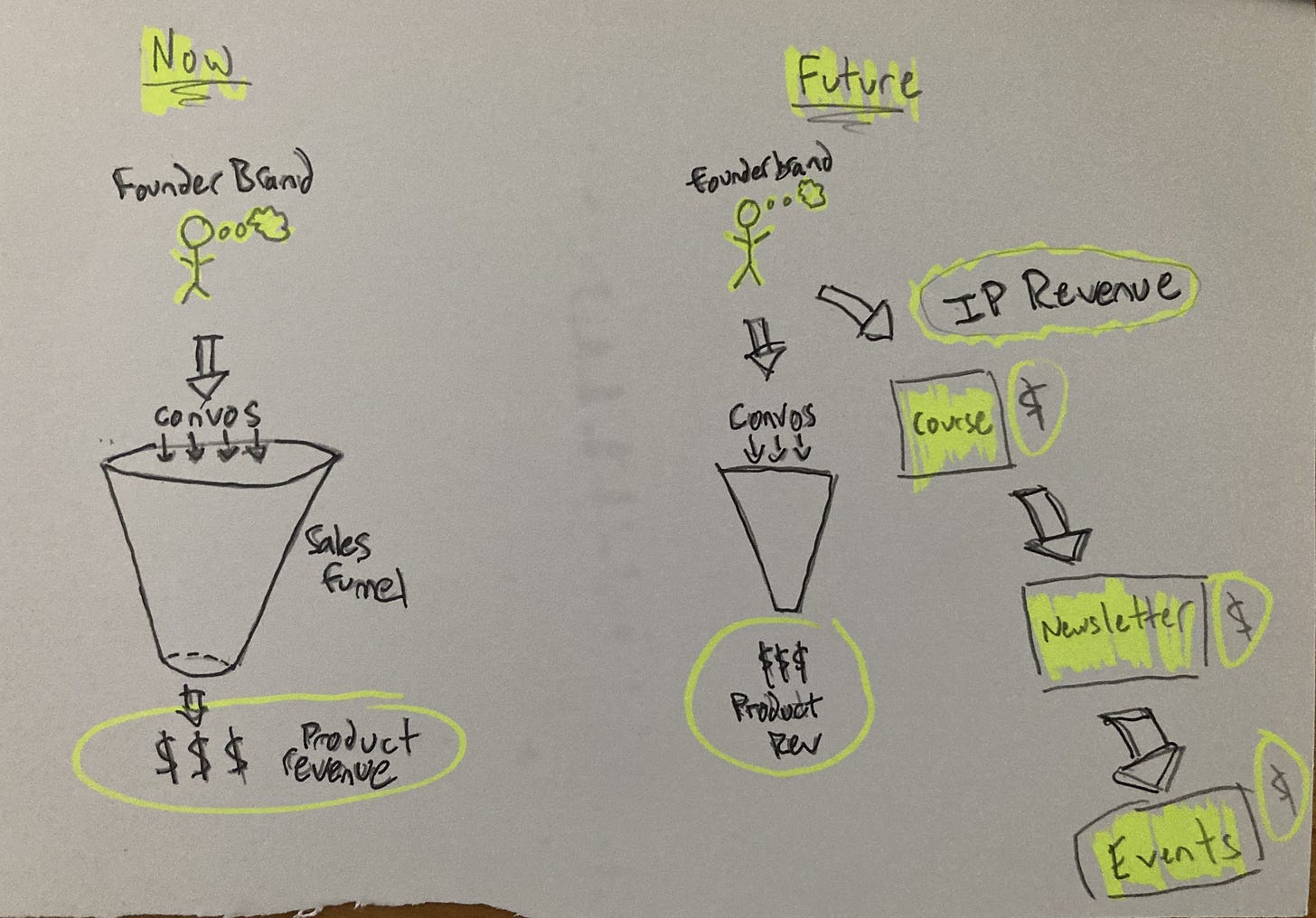

Building the Founder Brand

As the world of SaaS and plug-and-play solutions become more and more commoditized, how can B2B companies leverage content to build a more scalable business?

Invest heavily in the founder brand very, very early. Even before a product is built (Adam Robinson did this with RB2B).

Use the founder as the lightning rod and distribute the thought leadership content to all platforms that the target buying audience lives (typically LinkedIn).

Stay consistent with content and volume, and reap the benefits of the inbound flywheel.

This GTM motion is no longer a secret. Many companies already realizing significant upticks in the revenue of their business as a result of this unique motion.

The Next Chapter

Over time this motion will see diminishing returns. After enough saturation, buyers will tune-out knowing that this is just another GTM motion.

Instead of shelving this motion and moving on to the next “innovative GTM thing” that will inevitably emerge, companies can focus on monetizing the content beyond its value as a pure marketing motion.

The free-market thrives on a group of like buyers needing a solution to their problem, regardless of what form the solution takes (e.g. services, software or IP).

What if the content can be repackaged as a series of assets (e.g. video training courses, in-depth newsletter, quarterly research findings, etc.) and sold at a nominal cost?

If the founder has developed an audience of raving fans, a healthy percentage of that audience may buy their software and/or services solutions - which would be the ideal outcome.

However, there may be a percentage of that audience where those solutions may not be a fit - but a lighter weight version of the value in content form can still help them overcome challenges.

As this motion matures we will see a proliferation of B2B content creators with business models that look and feel very similar to today’s current podcaster, TikToker, Youtuber, etc. monetization strategies.

The best part? Once this content is created and repackaged, it is infinitely scalable - similar to SaaS, and with potential recurring revenue models.

“Solopreneurs” like Justin Welch makes all of his income from courses simply repackaged from the content he creates.

Conclusion

A focus on developing content around thought leadership will help grow core businesses, while the value of that IP can also unlock a much more scalable business opportunity over the long-term.

Services companies will likely never trade on a multiple of revenue. But if they can layer in a scalable, profitable and interesting revenue stream that can significantly improve EBITDA they can drive a larger acquisition price.