#34 - Yesterday, Today and Tomorrow

Even as the economy rebounds, layoffs in the tech sector—especially in sales—will continue.

While returning to growth mode is a top priority, the era of "growth at all costs" is officially over. Companies have already learned to do more with less, and AI will ensure this trend continues.

The market is responding accordingly. As M&A and IPO activity picks up, acquirers (both strategic and financial sponsors) are laser-focused on profitability.

Deals based on revenue multiples will likely be a thing of the past as fast-growing but unprofitable companies no longer command premium acquisition prices.

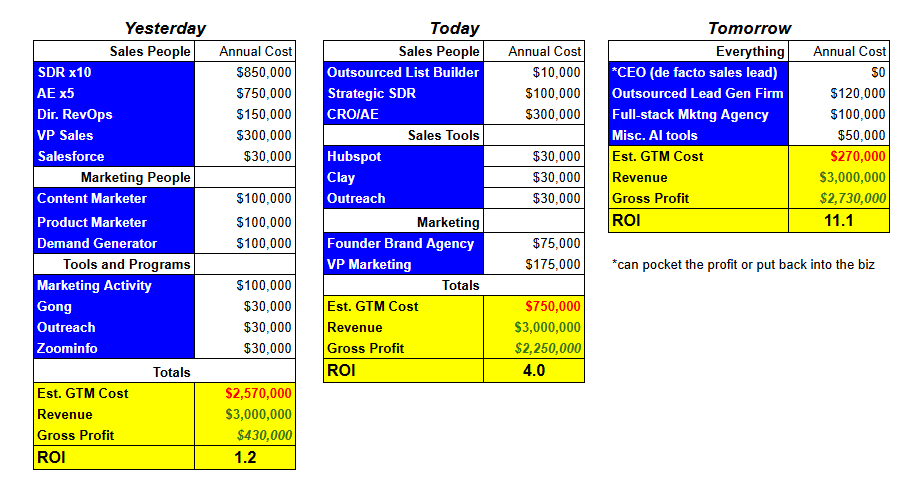

This shift marks a fundamental change in how tech businesses operate. Below I outline the timeline around this shift.

Yesterday: Growth at All Costs

Companies spent as much as they raised, hiring sales and marketing talent without a justification for ROI. In a competitive market, whatever company grew the fastest would win, so VCs pumped significant $$ into growth without abandon.

Once their company won, they’d achieve economies of scale and naturally, profitability would follow.

What actually happened was that when capital was cheap and abundant, the tech ecosystem thrived on a cycle of mutual back-scratching.

VCs pumped money into startups.

Startups sold products to each other.

Strategic acquirers & PE firms—often with deep VC ties—bought fast-growing but unprofitable companies, betting they could streamline operations post-acquisition.

In the era of Yesterday, sales and marketing teams operated with little financial scrutiny. As long as revenue grew, no one cared about efficiency. Startups routinely burned millions on headcount and expensive tools, assuming future funding rounds would cover the costs.

A typical Seed-stage company raising $10M at $1-5M in revenue would spend aggressively on product development while keeping GTM somewhat efficient—at least until a Series A round, when rapid hiring would inevitably push the GTM function into an unprofitable state.

Profitability was a distant concern.

Today: The Efficiency Era

Then, the music stopped.

Rising interest rates forced the industry to pivot from revenue growth to cash flow and profitability. In 2022, the market corrected hard: tech layoffs surged, budgets shrank, and GTM teams were forced to prove their financial ROI.

Surprisingly, many sales leaders now say that streamlining their teams and tech stacks has actually improved efficiency, productivity, and revenue growth.

With fewer resources, sales teams became scrappier, more focused, and ultimately more effective. Meanwhile, CROs are now judged as much on P&L as they are on revenue growth, ensuring there will be no return to "growth at all costs."

Sales tech is adapting to this new reality. Solutions like Clay consolidate multiple prospecting tools into one, allowing reps to work more efficiently and purchase software autonomously—often without CFO approval or company-wide adoption.

Tomorrow: The Rise of Automated GTM

A future without traditional sales teams is becoming increasingly plausible.

SDRs will no longer be in-house employees responsible for lead generation, prospect list building, and executing multi-step outreach sequences. This model is proving highly inefficient—entry-level reps are spread thin across multiple functions, unable to develop deep expertise in any one area. And with traditional activity-based metrics failing to yield predictable results, the cost burden of both tools and personnel remains on the company.

Instead, outsourced agencies with shared-services models will take over. These firms will structure SDR roles around specialized functions—research, list building, personalized email copywriting, or cold calling—maximizing efficiency through domain expertise while leveraging best-in-class technology at scale.

The same trend is emerging in marketing, with AI-powered agencies handling content and demand generation.

For bootstrapped founders prioritizing profitability, outsourcing entire GTM functions to AI-driven firms could become the norm.

Outbound prospecting could be fully outsourced, delivering highly qualified leads at scale.

Sales execution could be streamlined, with founders focused on closing deals rather than managing teams.

Marketing, sales, and even product development could be outsourced end-to-end.

While founders will still be responsible for identifying problems, building MVPs, and iterating toward product-market fit, scaling may look entirely different. AI-powered systems and external agencies could handle everything—without the overhead of a traditional GTM team.

The best part?

If founder/CEOs build businesses generating a few million bucks a year at really high-margins, there’s no pressure to grow if they can pocket most of it. Expect a significant reduction in unicorns over the next decade in favor of highly-profitable, digital, small businesses.