#40 - Is Calendly Screwed?

Will put it out here early in the article - I think Calendly is a super valuable tool. It’s just not a tool that justifies a $3B+ market cap.

I’m going to pick on them because they came up in conversation, but there are plenty of companies (ones that do have some value) that just raised way too much over the past few years and will never grow into their valuation.

I was chatting with a buddy who was VP of Sales at a large SaaS, and then moved to become Head of North America at a PE-backed company.

Back in 2020, at the peak of the pandemic’s shift to remote work, he rolled out Calendly licenses for his entire sales team. It was a no-brainer: the product worked. It solved an annoying, universal problem. His reps stopped wasting time on back-and-forth emails, customers loved it, and it just made everyone’s lives easier.

Fast forward a few years. He takes on a new leadership role at a new company. First item on his GTM wishlist? Calendly, again. This time, he’s ready to move fast. He knows the product. He knows the value. He just wants to buy.

But that’s not how it went.

Instead of a quick purchase, he’s forced through the standard enterprise gauntlet:

First, a BDR to “qualify” him. Then, an AE to “educate” him — on a product he already knew inside and out. By the end of the process, he was so turned off by the experience that he gave the deal to a competitor.

“I just wanted to buy the licenses. But they made me feel like I was shopping for an ERP system.”

From Product-Led Magic to VC-Driven Bloat

Calendly’s rise was one of the most celebrated growth stories of the last decade.

Founded in 2013, it was a breakout hit because it solved a specific, painful problem with remarkable simplicity. It didn’t need a sales team; it spread like wildfire through product-led growth (PLG). People signed up, loved it, and invited others.

In 2021, Calendly raised a $350 million Series B at a $3 billion valuation — one of the largest SaaS deals of the ZIRP era. It was a classic VC success story: big market, viral adoption, massive TAM expansion ahead.

But raising that much money rewires everything.

Suddenly, you’re no longer just building a great product — you’re expected to build an enterprise. You start hiring AEs, BDRs, SDRs, CROs. You need to “go upmarket” to justify the headcount. You’re not content with serving individuals and small teams; you need to sell to Fortune 500s.

And then you hit the wall.

The Copycat Risk — And Why the Moat Was Always Thin

Calendly’s core problem today isn’t just bloat — it’s that the product was never defensible in the way venture capital assumed.

The truth is: scheduling tools are easy to copy. Google Calendar, Microsoft Outlook, HubSpot, Zoom, and Salesforce all offer embedded scheduling links now. Startups like SavvyCal and Motion are eating into the market by offering similar features with slightly better UX or positioning.

Calendly wasn’t built on breakthrough technology; it was built on speed-to-market during a liquidity bubble. Once capital becomes expensive and competition commoditizes the category, that advantage evaporates.

The SaaS Efficiency Gap: Calendly as Case Study

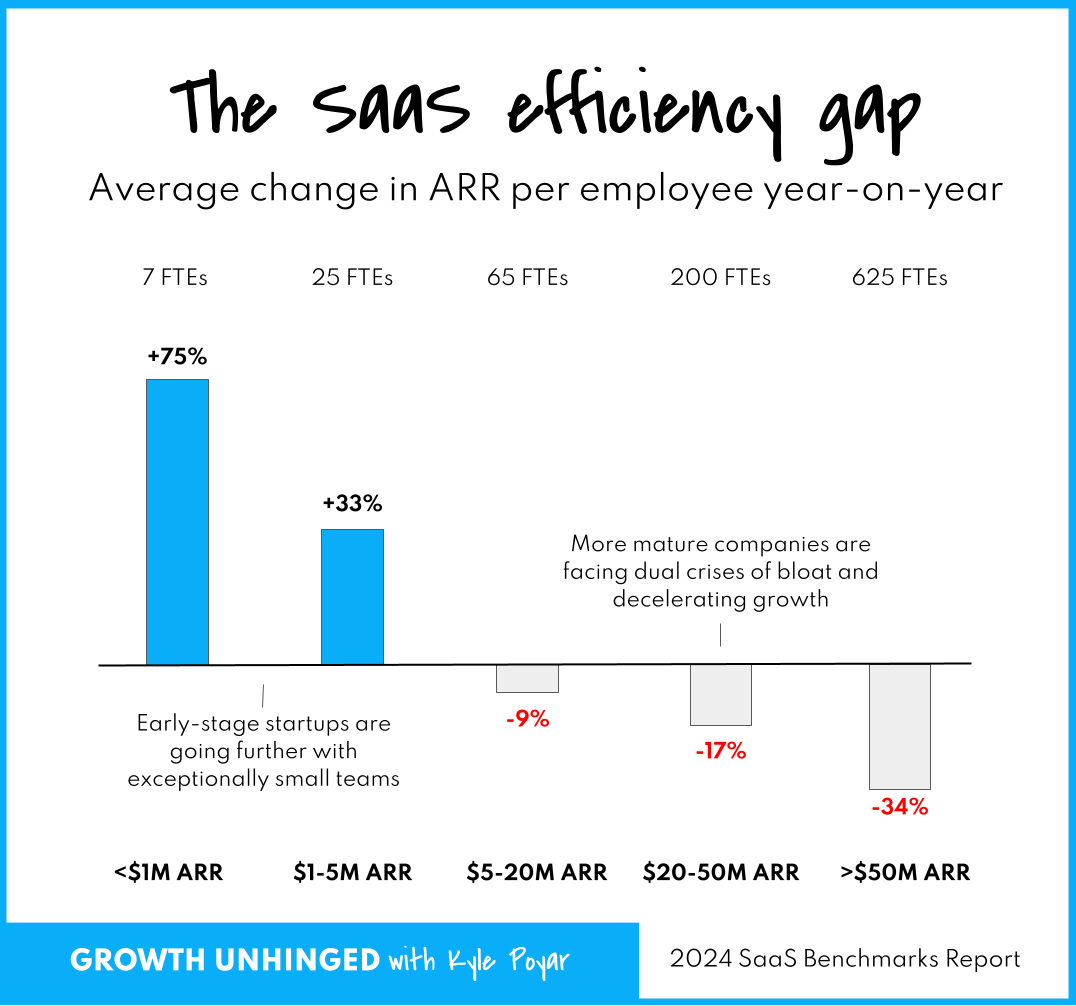

The chart from Kyle Poyar’s “Growth Unhinged” newsletter tells the broader story here.

Early-stage SaaS companies (<$1M ARR) are seeing +75% growth in ARR per employee year-over-year. But mature companies (>$50M ARR) are facing negative returns — -34% ARR per employee — as they grapple with bloated teams, slowing growth, and markets that no longer justify their valuations.

Calendly is squarely in that camp.

Public estimates suggest it’s somewhere between $100–150M ARR. It’s hired and fired multiple CROs in the past few years. It’s lost the PLG magic that made it special, and now it’s stuck trying to build an enterprise sales engine for a product people fundamentally want to buy on their own.

The Bigger Takeaway: When SaaS Peaks at $50M

Calendly’s story isn’t unique.

We’re entering a new era where many SaaS companies — flush with cash raised during ZIRP — have hit the ceiling. They’ve maxed out their core product’s market. They don’t have a second act. They’re stuck at $50–100M ARR, bloated with GTM hires, pressured by investors, and facing copycat competitors who can match them feature-for-feature, but run leaner and cheaper.

In this world, the old VC playbook starts to break down.

You can’t brute-force your way to the next growth stage with headcount. You can’t justify a $3B valuation on a product that’s easily bundled by Google or Microsoft. And you can’t force customers who love your product into an enterprise sales process that they never asked for.

Where Does Calendly Go From Here?

There are only a few roads left:

A slow march toward profitability, shrinking the GTM org back to what the product actually needs.

A markdown sale to private equity, where it becomes a quiet cash-generating utility.

A pivot, or expansion, into an adjacent product line (but nothing obvious has emerged yet).

For founders and operators, it’s a clear lesson:

Simplicity scales — but only so far. Capital is not a moat. And when you overbuild the machine, it can eat the very product that made you successful.

Calendly was built to save us from calendar ping-pong.

Instead, it got trapped in a game of venture-funded ping-pong, chasing growth at all costs — and now, like many SaaS companies of its era, it’s struggling to find what’s next.